Estimate payroll taxes 2023

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period. Next years estimate For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

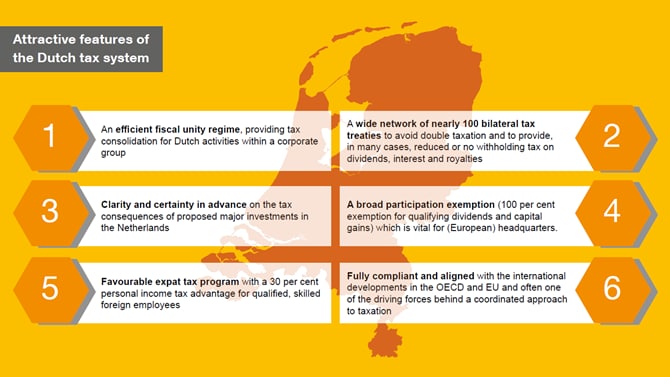

Tax Rates In The Netherlands 2022 Expatax

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

. CNBC reported that a recent congressional. 1 day agoThe rates have gone up over time though the rate has been largely unchanged since 1992. The basic standard deduction for 2023 will be.

Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Estimate your federal income tax withholding. The corresponding annual payroll tax increase would be about 450 for.

It comprises the following components. Start the TAXstimator Then select your IRS Tax Return Filing Status. 2022 Federal income tax withholding calculation.

Federal payroll tax rates for 2022 are. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Subtract 12900 for Married otherwise.

The SSA provides three forecasts for the wage base. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The annual threshold is adjusted if you are not an employer for a. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

Estimated Income Tax Payments For 2022 And 2023 Pay Online Social Security Fund Would Be Empty By 2023 If Payroll Taxes Were Cut Actuary Estimates Strategies To. The standard FUTA tax rate is. 62 for the employee.

Compare and Find the Best Paycheck Software in the Industry. And the remaining 15000 x 22 22 to produce taxes per. Ad Simplify Your Day-to-Day With The Best Payroll Services.

No Need to Transfer Your Old Payroll Data into the New Year. In 2023 these deductions. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

Get Started for Free. Ad Process Payroll Faster Easier With ADP Payroll. Estimate your tax withholding with the new Form W-4P.

Get Started With ADP Payroll. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

When figuring your estimated tax for the. Joint return or surviving spouse 27700 25900 for 2022 Single not head of household or surviving spouse 13850. The next chunk up to 41775 x 12 12.

If the 2023 Taxable Wage Base increases by 5 for 2023 the increase would be 5880 to 152880. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents. 2022 Federal income tax withholding calculation.

Tax Year 2023 is from January 1 until December 31 2023. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More.

According to the annual report for 2023 the wage base will be 155100 up from 147000 in 2022 and 142800 in 2021. Estimate your tax refund with HR Blocks free income tax calculator. Subtract 12900 for Married otherwise.

Get Started With ADP Payroll. This page is being updated for Tax Year 2023 as. You report and pay Class 1A on these types of payments during the tax year as part of your payroll.

Ad Easily Approve Automated Matching Suggestions or Make Changes and Additions. Ad Start Afresh in 2022. Compare Sonarys Most Recommended Payroll Find The Perfect Match For Your Business.

Compare Side-by-Side the Best Payroll Service for Your Business. Master todays concepts and the skills needed to calculate payroll complete payroll taxes and prepare payroll records and reports with BiegToland s market-leading PAYROLL. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Social Security tax rate. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Components of Payroll Tax.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Break the taxable income into tax brackets the first 10275 x 1 10. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Get Started With ADP Payroll. Prepare and e-File 2023 Tax Returns starting in January 2024.

You have nonresident alien status. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

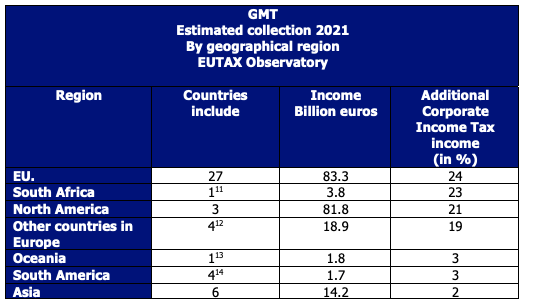

Global Minimum Tax Gmt Oecd Pillar 2 The Decisive Moment Inter American Center Of Tax Administrations

Register Your Dog Service Dog Emotional Support Animal Registration Service Dog Registration Emotional Support Animal Service Dogs

Tax Rates In The Netherlands 2022 Expatax

Wage And Income Tax Outline

Minimum Corporate Taxation

2022 Federal State Payroll Tax Rates For Employers

What Is The Bonus Tax Rate For 2022 Hourly Inc

2022 Federal State Payroll Tax Rates For Employers

Tax Benefits For Entrepeneurs Take Advantage Of The Available Deductions And Benefits Expatax

Wage And Income Tax Outline

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

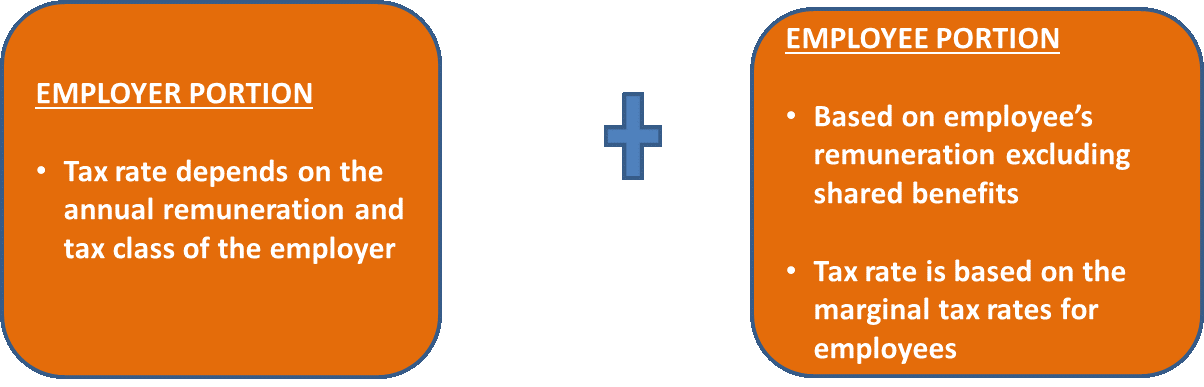

Payroll Tax Government Of Bermuda

Minimum Corporate Taxation

Tax Calculator For Netherlands Salary Calculator 2022

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Spring Memorandum Tax Measures Meijburg Co Tax Legal

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands